Trade Review and Tips for Trading the British Pound

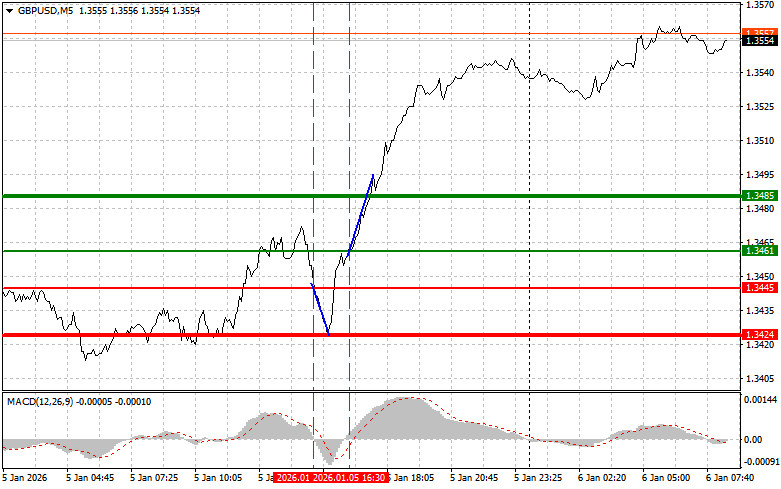

The test of the 1.3445 price level occurred at the moment when the MACD indicator was just starting to move downward from the zero line, which confirmed a correct entry point for selling the pound. As a result, the pair declined toward the target level of 1.3424. Closer to the middle of the US trading session, a test of the 1.3461 price level coincided with the moment when MACD began moving upward from the zero line, which made it possible to buy the pound. As a result, the pair rose by more than 30 points.

This morning, the GBP/USD pair is showing consolidation near the recently reached highs, trading within a narrow range. Traders have taken a wait-and-see approach, assessing the further outlook. Yesterday's impulse was strong enough, but new growth drivers are needed to consolidate the gains.

Market attention is now focused on the upcoming releases of economic data from both the United Kingdom and the United States. This morning, the spotlight will be on the publication of the UK services PMI and the composite PMI. These indicators play a key role in understanding the state of the economy and forecasting the dynamics of the pound. They serve as a gauge reflecting the current condition of the UK economy and business sentiment. If the actual figures exceed forecasts, this could support the pound, signaling economic resilience and potentially encouraging the Bank of England to pause its rate-cutting cycle. Conversely, weaker-than-expected data indicating slower growth could negatively affect the pound, pushing the Bank of England toward a more accommodative monetary policy stance.

As for the intraday strategy, I will rely more on the implementation of Scenarios No. 1 and No. 2.

Buy Scenarios

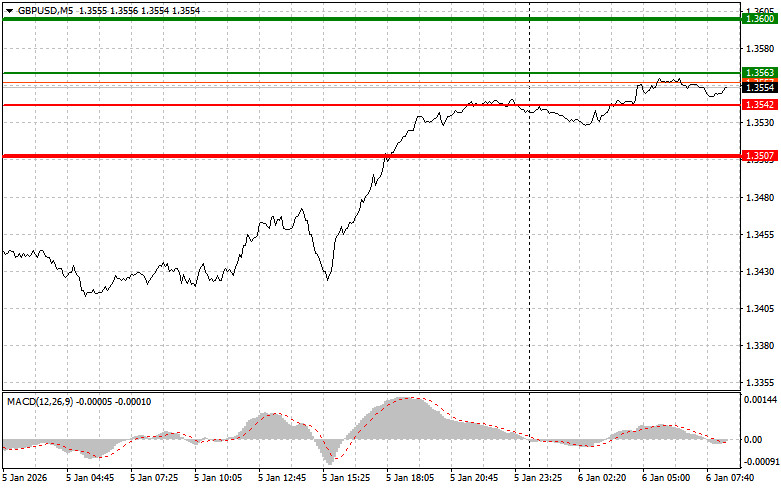

Scenario No. 1: Today, I plan to buy the pound if the entry point is reached around 1.3563 (thin green line on the chart), with a target of growth toward the 1.3600 level (thicker green line on the chart). Around 1.3600, I plan to exit long positions and open short positions in the opposite direction, aiming for a move of 30–35 points in the opposite direction from this level. Strong pound growth today can be expected after positive economic data.Important! Before buying, make sure that the MACD indicator is above the zero line and is just starting to rise from it.

Scenario No. 2: I also plan to buy the pound today in the event of two consecutive tests of the 1.3542 price level while the MACD indicator is in the oversold area. This would limit the pair's downward potential and lead to a reversal of the market upward. Growth toward the opposite levels of 1.3563 and 1.3600 can be expected.

Sell Scenarios

Scenario No. 1: Today, I plan to sell the pound after a break below the 1.3542 level (red line on the chart), which could lead to a rapid decline in the pair. The key target for sellers will be the 1.3507 level, where I plan to exit short positions and also immediately open long positions in the opposite direction, aiming for a move of 20–25 points in the opposite direction from this level. Pound sellers may become active after weak economic data.Important! Before selling, make sure that the MACD indicator is below the zero line and is just starting to decline from it.

Scenario No. 2: I also plan to sell the pound today in the event of two consecutive tests of the 1.3563 price level while the MACD indicator is in the overbought area. This would limit the pair's upward potential and lead to a reversal of the market downward. A decline toward the opposite levels of 1.3542 and 1.3507 can be expected.

What's on the Chart

- Thin green line – the entry price at which the trading instrument can be bought;

- Thick green line – the estimated price level where Take Profit orders can be placed or profits can be taken manually, as further growth above this level is unlikely;

- Thin red line – the entry price at which the trading instrument can be sold;

- Thick red line – the estimated price level where Take Profit orders can be placed or profits can be taken manually, as further decline below this level is unlikely;

- MACD indicator – when entering the market, it is important to rely on overbought and oversold zones.

Important. Beginner Forex traders should be extremely cautious when making market entry decisions. Ahead of major fundamental reports, it is best to stay out of the market to avoid sharp price fluctuations. If you decide to trade during news releases, always place stop orders to minimize losses. Without stop orders, you can very quickly lose your entire deposit, especially if you do not use proper money management and trade large volumes.

And remember that successful trading requires a clear trading plan, such as the one presented above. Making spontaneous trading decisions based on the current market situation is inherently a losing strategy for an intraday trader.