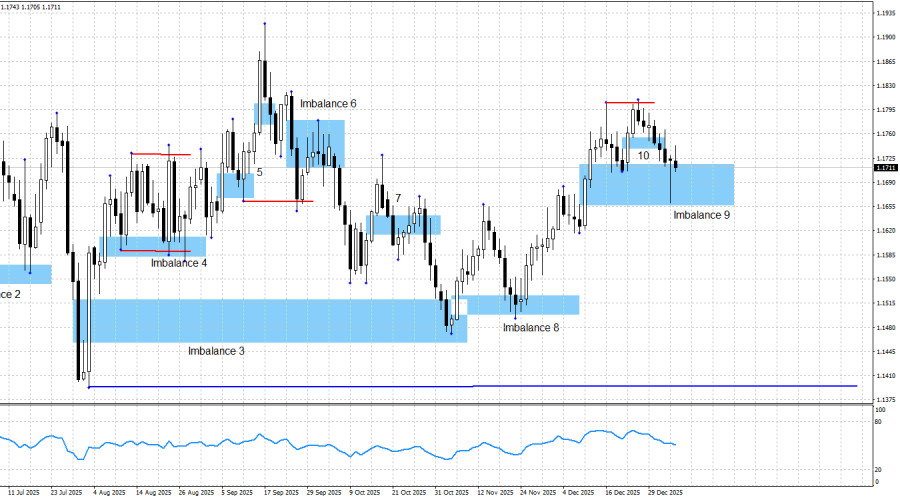

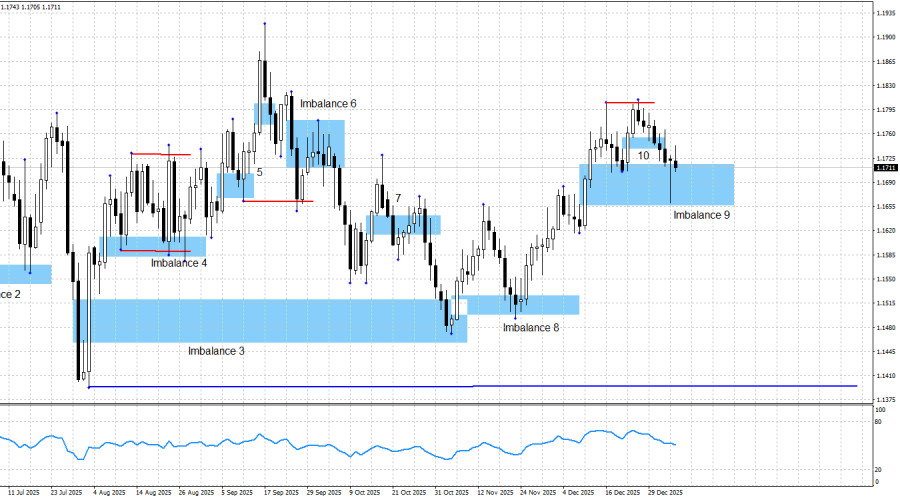

On Monday, the EUR/USD pair posted a sharp decline to the bottom of imbalance 9, but by the end of the day it returned to its opening levels. In candlestick analysis, this formation is known as a "Hammer", which is a precursor to a reversal. It would have been better if this Hammer had also swept liquidity from a significant swing, but there are no major swings within the imbalance 9 zone. Therefore, I continue to expect a bullish reaction from imbalance 9. Let me remind you that one imbalance can be traded multiple times — the Smart Money system does not prohibit this. Personally, I try to use only the first reaction in trading, but exceptions exist to any rule. Thus, only the bulls themselves can save the bulls, and they need to do so as quickly as possible — this week. If bulls manage to restore the euro's positions, the reaction to imbalance 9 can then be considered a double reaction.

Two weeks ago, liquidity was swept from the swing dated December 16, after which the euro's decline began. The pair's decline may already be completed this week, since bullish imbalance 9 is still acting as a support zone for price. The news background for the dollar will be very challenging this week, and there are all the prerequisites for a bearish retreat.

The technical picture continues to signal bullish dominance. The bullish trend remains in place, but traders currently need fresh signals. Such signals can only form within imbalance 9. If bearish patterns appear or bullish ones are invalidated, the trading strategy will need to be adjusted. However, at the moment, there are no grounds for doing so.

The news background on Tuesday was very weak. Germany released an inflation report that did not interest traders, just like the manufacturing PMI indices in Germany, the EU, and the US. The most interesting events this week are scheduled for Wednesday and Friday. Therefore — full readiness mode.

The bulls have had plenty of reasons for a renewed offensive for the past three months, and all of them remain relevant. These include the dovish (in any case) outlook for FOMC monetary policy, Donald Trump's overall policy (which has not changed recently), the US–China confrontation (where only a temporary truce has been reached), protests by the American public against Trump under the "No Kings" banner, labor market weakness, bleak prospects for the US economy (recession), and the government shutdown (which lasted a month and a half but was clearly not priced in by traders). Thus, in my view, further growth of the pair is entirely logical.

One should also not lose sight of Trump's trade war and his pressure on the FOMC. Recently, new tariffs have been introduced less frequently, and Trump has stopped criticizing the Fed. However, I personally believe this is just another temporary lull. In recent months, the FOMC has been easing monetary policy, which is why there has been no new wave of criticism from Trump. But this does not mean that these factors no longer create problems for the dollar.

I still do not believe in a bearish trend. The news background remains extremely difficult to interpret in favor of the dollar, which is why I am not trying to do so. The blue line marks the price level below which the bullish trend could be considered finished. To reach it, bears would need to push the price down by about 300 points, and I consider this task impossible under the current news background and circumstances. The nearest upward target for the euro remains the bearish imbalance at 1.1976–1.2092 on the weekly chart, which was formed back in June 2021.

News Calendar for the US and the Eurozone:

- Eurozone – Change in German Retail Sales (07:00 UTC)

- Eurozone – German Unemployment Rate (08:55 UTC)

- Eurozone – Change in German Unemployment (08:55 UTC)

- Eurozone – Consumer Price Index (10:00 UTC)

- United States – ADP Employment Change (13:15 UTC)

- United States – ISM Services PMI (15:00 UTC)

- United States – JOLTS Job Openings (15:00 UTC)

January 7 includes seven economic events, three of which are very important (US-related). The impact of the news background on market sentiment on Wednesday could be strong, especially in the second half of the day.

EUR/USD Forecast and Trading Advice:

In my view, the pair may be in the final stage of the bullish trend. Despite the fact that the news background remains on the side of the bulls, bears have attacked more frequently in recent months. Still, I do not see realistic reasons for the start of a bearish trend at this time.

Traders had opportunities to buy the euro from imbalances 1, 2, 4, and 5, and in all cases, we saw some price growth. There were also opportunities to open new trend-following long positions after reactions from bullish imbalance 3, imbalance 8, and later after the rebound from imbalance 9. This week, a second reaction to bullish imbalance 9 may occur. The target for euro growth remains 1.1976. Opening new long positions is acceptable (quite permissible).