Trade Review and Trading Advice for the European Currency

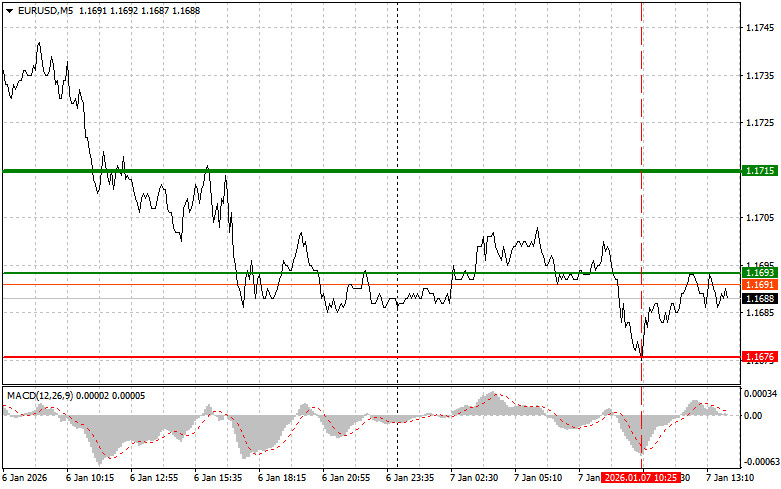

The test of the 1.1676 price level occurred when the MACD indicator had already moved significantly below the zero line, which limited the pair's downward potential. For this reason, I did not sell the euro.

The slowdown in the growth of the eurozone core Consumer Price Index to 2.3% is almost fully in line with the target levels set by the European Central Bank. This favorable trend creates the prerequisites for a potential adjustment of the current monetary policy if necessary. However, a balanced approach is essential now to support economic recovery and ensure price stability in the eurozone over the long term.

In the near term, data will be released from ADP on changes in private-sector employment, information on job openings and labor turnover from the Bureau of Labor Statistics, as well as the ISM Services PMI. Experts will pay particular attention to the ADP data in order to assess the scale of new job creation in the private sector following the sharp decline seen in November. The JOLTS report, published by the Bureau of Labor Statistics, will provide valuable insight into changes in labor demand and employees' willingness to change jobs. The ISM Services PMI will reflect sentiment in one of the key sectors of the U.S. economy. A reading above 50 indicates expansion, while a reading below 50 signals contraction. This indicator is highly important, as the services sector plays a central role in shaping GDP and employment in the country.

As for the intraday strategy, I will primarily rely on the implementation of Scenarios No. 1 and No. 2.

Buy Signal

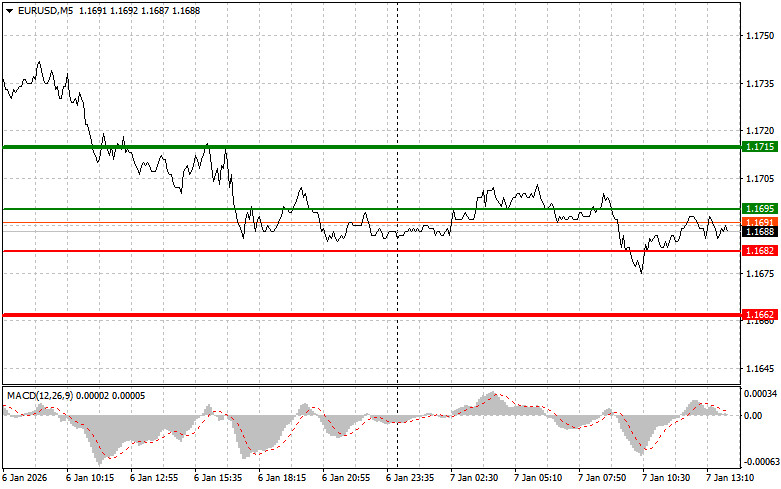

Scenario No. 1: Today, the euro can be bought if the price reaches the level around 1.1695 (green line on the chart), with a target of growth toward the 1.1715 level. At 1.1715, I plan to exit the market and also open short positions in the opposite direction, targeting a move of 30–35 points from the entry point. A strong rise in the euro can be expected only after weak U.S. data.Important! Before buying, make sure the MACD indicator is above the zero line and is just beginning to rise from it.

Scenario No. 2: I also plan to buy the euro today in the case of two consecutive tests of the 1.1682 level when the MACD indicator is in oversold territory. This would limit the pair's downward potential and lead to a reversal of the market upward. Growth toward the opposite levels of 1.1695 and 1.1715 can be expected.

Sell Signal

Scenario No. 1: I plan to sell the euro after the price reaches the 1.1682 level (red line on the chart). The target will be the 1.1662 level, where I intend to exit the market and immediately open buy positions in the opposite direction (targeting a 20–25 point move in the opposite direction from the level). Pressure on the pair may return at any moment.Important! Before selling, make sure the MACD indicator is below the zero line and is just beginning to move lower from it.

Scenario No. 2: I also plan to sell the euro today in the case of two consecutive tests of the 1.1695 level when the MACD indicator is in overbought territory. This would limit the pair's upward potential and lead to a reversal of the market downward. A decline toward the opposite levels of 1.1682 and 1.1662 can be expected.

What's on the Chart:

- Thin green line – entry price at which the trading instrument can be bought;

- Thick green line – estimated price level where Take Profit can be set or profits can be locked in manually, as further growth above this level is unlikely;

- Thin red line – entry price at which the trading instrument can be sold;

- Thick red line – estimated price level where Take Profit can be set or profits can be locked in manually, as further decline below this level is unlikely;

- MACD indicator – when entering the market, it is important to be guided by overbought and oversold zones.

Important. Beginner traders in the Forex market should be extremely cautious when making entry decisions. Ahead of the release of major fundamental reports, it is best to stay out of the market to avoid sharp price fluctuations. If you decide to trade during news releases, always place stop orders to minimize losses. Without stop orders, you can lose your entire deposit very quickly, especially if you do not use proper money management and trade large volumes.

And remember that successful trading requires a clear trading plan, like the one presented above. Spontaneous trading decisions based on the current market situation are an inherently losing strategy for an intraday trader.