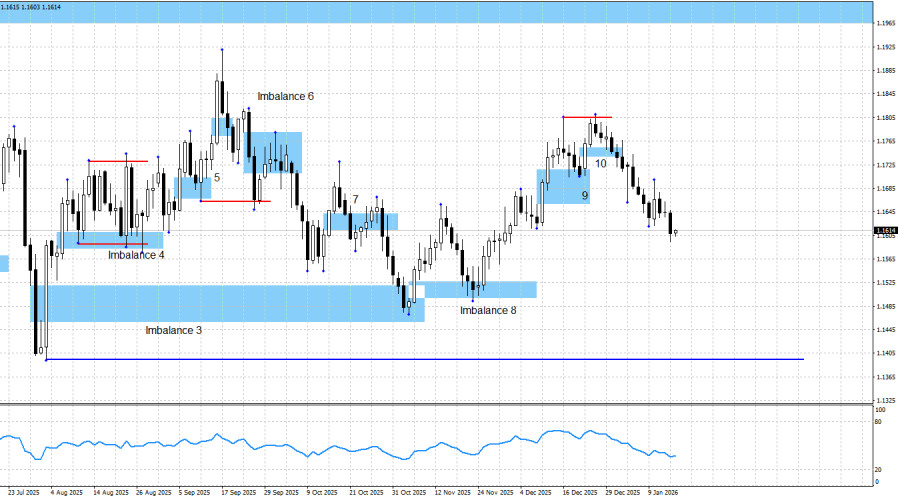

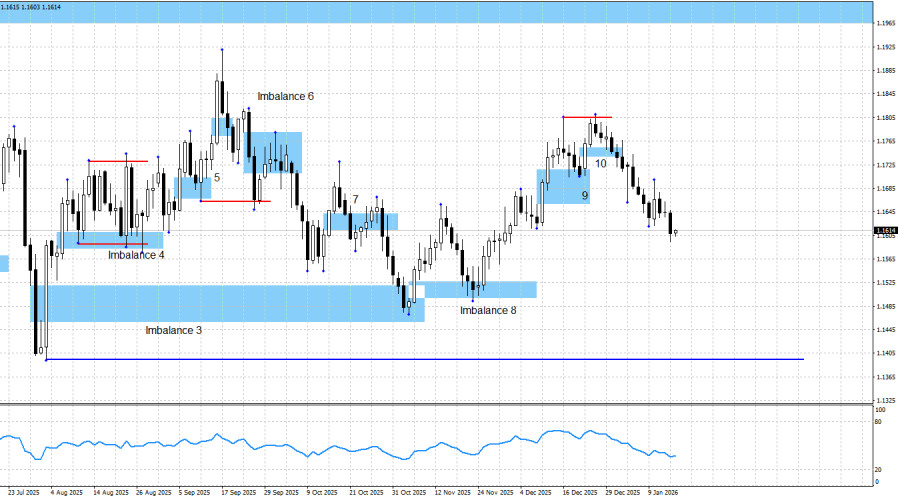

The EUR/USD pair has continued its decline for the sixteenth day in a row. Now that three weeks have already passed since the start of the drop, it is time to ask the question: why is the market buying the dollar at all? I find it difficult to answer this, as there was virtually no news at the end of 2025 (holidays), and at the beginning of 2026 most of the news clearly did not favor the bears. And yet, it is the bears who are attacking. I would even say they are not "attacking," but slowly pressing the market lower. However, this gradual pressure has been enough to keep the European currency falling for three weeks, while largely ignoring the technical picture. The only factor that warned of a possible decline was the liquidity grab on December 24.

At the moment, traders have two possible trading options. Since the bullish trend remains intact despite the local loss of initiative by the bulls, one can wait for the formation of new bullish patterns or at least liquidity grabs from clearly defined bearish swings. The second option is to trade short from bearish patterns—which are currently absent but may appear in the future. However, under the current circumstances, the decline in the pair may represent nothing more than a corrective pullback, which should be kept in mind.

The technical picture continues to signal bullish dominance, but only in the long term. The bullish trend remains in place, but it is merely being maintained rather than developing. A new bullish signal may not form for quite some time, as there are currently no valid, workable bullish patterns.

There is little point in analyzing the news background on Friday, as the market is ignoring virtually all news while only bears remain active. Yesterday, the European Union released a fairly strong industrial production report, which triggered no reaction from traders. U.S. reports were of minor importance, yet traders chose to take them into account. As a result, factors positive for the euro are being ignored, while those positive for the dollar are being priced in. This explains the three-week decline in the EUR/USD pair.

The bulls have had plenty of reasons for a new offensive for the past four to five months, and all of them remain relevant over the long term. These include the dovish (in any case) outlook for FOMC monetary policy, Donald Trump's overall policy (which has not changed recently), the confrontation between the U.S. and China (where only a temporary truce has been reached), protests by the American public against Trump under the "No Kings" banner, weakness in the labor market, bleak prospects for the U.S. economy (recession), and the government shutdown (which lasted a month and a half but was clearly not priced in by traders). Now this list also includes U.S. military aggression toward certain countries and the criminal prosecution of Powell. Thus, in my view, further growth of the pair would be entirely justified.

I still do not believe in a bearish trend. The news background remains extremely difficult to interpret in favor of the dollar, which is why I do not attempt to do so. The blue line marks the price level below which the bullish trend could be considered finished. For bears to reach that level, the price would need to fall by about 210 pips, and I consider this task unachievable under the current news background and circumstances. The nearest upside target for the European currency remains the bearish imbalance at 1.1976–1.2092 on the weekly chart, which was formed back in June 2021.

News Calendar for the U.S. and the Eurozone:

Eurozone – Consumer Price Index (10:00 UTC).

On January 19, the economic calendar contains one noteworthy event. The impact of the news background on market sentiment on Monday may be observed in the first half of the day.

EUR/USD Forecast and Trading Advice:

In my view, the pair remains in the process of forming a bullish trend. Despite the fact that the news background continues to favor the bulls, bears have been more active in recent months and weeks. Nevertheless, I see no realistic reasons for the start of a bearish trend.

From imbalances 1, 2, 4, 5, 3, 8, and 9, traders had opportunities to buy the euro. In all cases, we observed a certain rise. New long positions are acceptable if a new bullish signal is formed. However, at the moment, there are no workable patterns—neither bearish nor bullish.