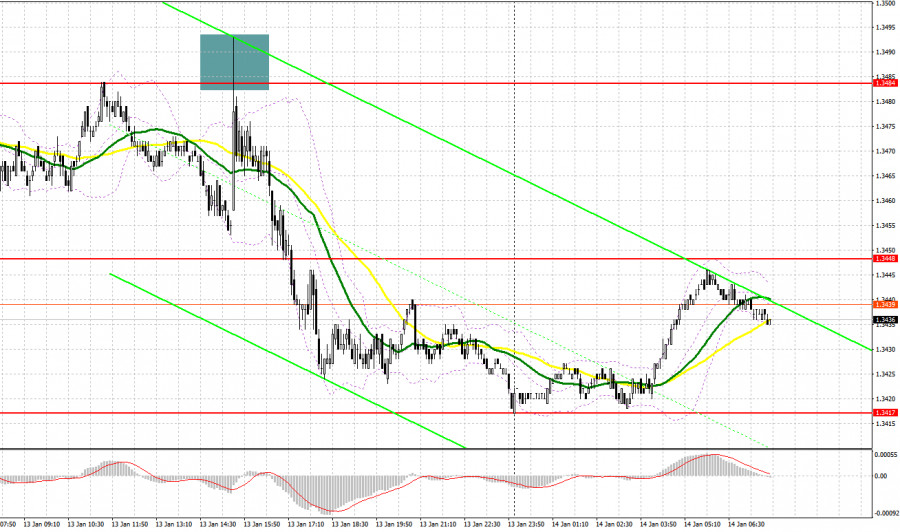

Several entry points into the market were formed yesterday. Let's look at the 5-minute chart and figure out what happened there. In my morning forecast, I highlighted the 1.3484 level and planned to make entry decisions based on it. The rise and formation of a false breakout around 1.3484 led to a short entry on the pound, resulting in a decline of about 15 pips. In the second half of the day, the story around 1.3484 repeated. This time, the pair fell by more than 60 pips.

For opening long positions on GBPUSD, it is required:

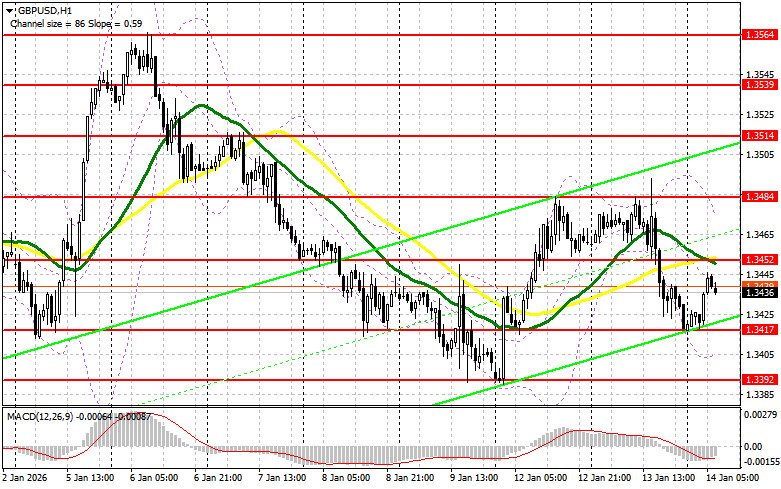

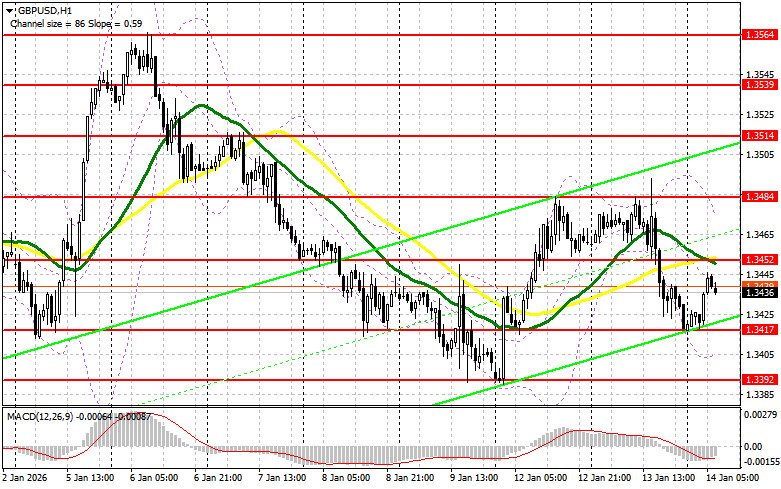

US inflation in December rose by 0.3%, coming in above economists' forecasts, which led to pound weakness and a strengthening of the US dollar. The data were a convincing argument that the Federal Reserve will not cut interest rates in the near term. Today, only a speech by Bank of England MPC member Alan Taylor is expected. Considering that even Bailey's speech yesterday did not help the pound to rise, we should not count on Taylor to do much. If selling pressure returns to the pair, bulls can count on the nearest support at 1.3417, which formed yesterday. Only the formation of a false breakout there would be a good option to open long positions targeting a rise to resistance at 1.3452. A breakout and reverse test from above to below that range would improve the chances for GBP/USD to strengthen, triggering sellers' stops and providing a suitable entry for longs with a potential exit to 1.3484, where I expect a more active seller reaction. The furthest target will be the 1.3514 area, where I plan to take profits. If GBP/USD falls and there is no buyer activity at 1.3417, pressure on the pair will only increase, leading to a move toward the next support at 1.3392. Only the formation of a false breakout there would be a suitable condition to open long positions. I plan to buy GBP/USD immediately on a rebound from the 1.3370 low, targeting a 30–35-pip intraday correction.

For opening short positions on GBPUSD, it is required:

Sellers are trying to take full control of the market, and only a breakout of a few levels is missing. In the case of a small correction in the first half of the day after Taylor's speech, only the formation of a false breakout around 1.3452 will be a reason to sell GBP/USD, targeting a decline to support at 1.3417. A breakout and reverse test from below to above of that range will deliver a larger blow to buyers' positions, triggering stop losses and opening the way to 1.3392. The furthest target will be the 1.3370 area, where I will take profit. A test of that level will lead to the establishment of a new bearish trend. In the case of GBP/USD rising and no seller activity at 1.3452 — where moving averages run and favor the bears — buyers will get a chance for a correction to the 1.3484 area. I plan to open shorts there only on a false breakout, as I did yesterday. If there is no downward movement there either, I will sell GBP/USD immediately on the rebound from 1.3514, but only expecting a 30–35 pip intraday correction downward.

I recommend for review:

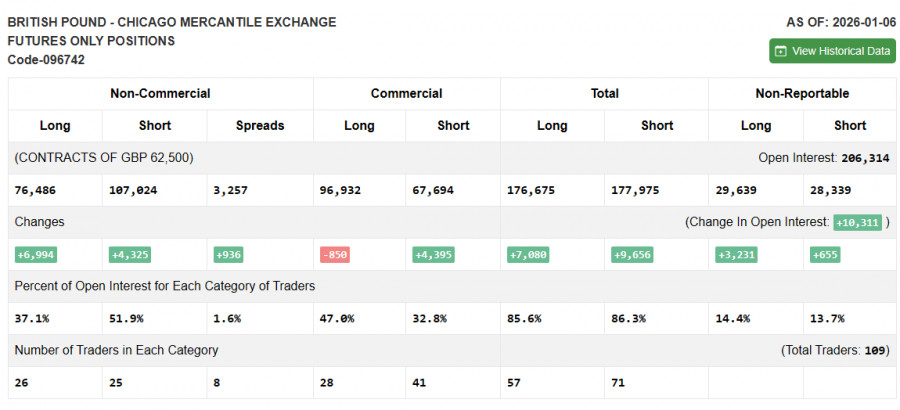

The COT report (Commitment of Traders) for January 6 showed growth in both long and short positions. The probability of US rate cuts weakened substantially after the latest US labor market data, but a new risk for the dollar emerged: sharp pressure from the Trump administration on the Fed, which could lead to continued dollar problems and short-term growth of the British pound. At the same time, Bank of England policy remains restrained, indicating their clear plans to continue fighting inflation, although this has not given much confidence to pound buyers recently. The latest COT report indicates that non-commercial long positions increased by 6,994 to 76,486, while non-commercial short positions rose by 4,325 to 107,024. As a result, the spread between longs and shorts widened by 936.

Indicator signals

Moving averages

Trading is below the 30- and 50-day moving averages, indicating a possible decline in the pair.

Note: The period and price basis of the moving averages are considered by the author on the hourly H1 chart and differ from the standard definition of classic daily moving averages on the D1 chart.

Bollinger Bands

In case of a decline, the indicator's lower band around 1.3400 will provide support.

Indicator descriptions

- Moving average — smooths volatility and noise to determine the current trend. Period — 50. Marked in yellow on the chart.

- Moving average — smooths volatility and noise to determine the current trend. Period — 30. Marked in green on the chart.

- MACD (Moving Average Convergence/Divergence) — fast EMA period 12, slow EMA period 26, signal SMA period 9.

- Bollinger Bands — period 20.

- Non-commercial traders — speculators such as retail traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain criteria.

- Non-commercial long positions — the total long open position of non-commercial traders.

- Non-commercial short positions — the total short open position of non-commercial traders.

- Net non-commercial position — the difference between non-commercial long and short positions.