Trade Analysis and Trading Advice for the British Pound

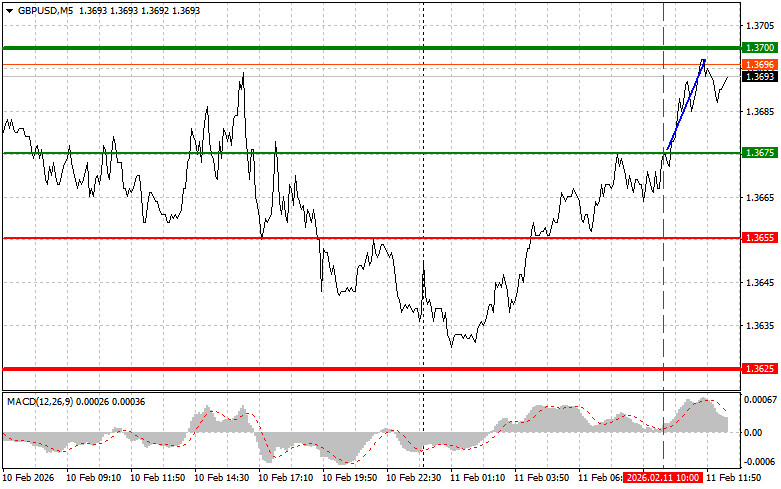

The test of the 1.3675 level occurred when the MACD indicator was just beginning to move upward from the zero line, confirming a proper entry point for buying the pound. As a result, the pair rose by more than 20 points.

Despite the absence of economic data in the first half of the day, the British pound showed relative stability and returned to the weekly high area. This recovery, despite the relative calm, maintains good prospects for potential GBP/USD growth.

Ahead of us are the January data on Nonfarm Payrolls, the U.S. unemployment rate, average hourly earnings, and changes in private-sector employment. These indicators, published by the U.S. Department of Labor, are among the most anticipated by analysts, investors, and policymakers, as they provide a comprehensive picture of the U.S. labor market and, consequently, the overall health of the economy.

Changes in nonfarm employment are traditionally considered the main driver of the report. Growth in this indicator signals expanding business activity, increased production, and higher demand for labor. It is often a key factor in central bank interest rate decisions.

The unemployment rate, the second most important indicator, reflects the share of the economically active population that is actively seeking work but cannot find it. A low unemployment rate usually correlates with a strong labor market and may contribute to rising inflation due to wage growth. A decline in unemployment is a positive signal, but it should be analyzed together with other indicators to avoid one-sided conclusions.

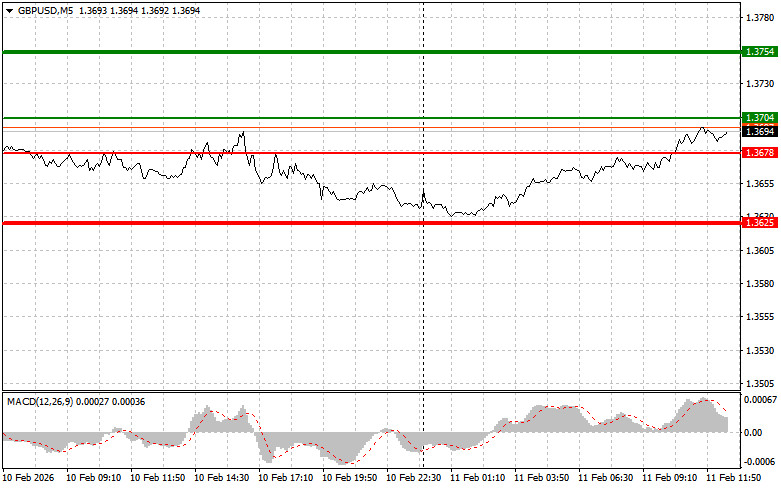

As for the intraday strategy, I will mainly rely on implementing Scenarios No. 1 and No. 2.

Buy Signal

Scenario No. 1: I plan to buy the pound today upon reaching the entry point around 1.3704 (green line on the chart), targeting growth to 1.3754 (thicker green line on the chart). Around 1.3754, I will exit long positions and open short positions in the opposite direction (expecting a 30–35 point move in the opposite direction). Pound growth today can be expected after weak U.S. data.Important! Before buying, make sure the MACD indicator is above the zero line and just beginning to rise from it.

Scenario No. 2: I also plan to buy the pound today in case of two consecutive tests of the 1.3678 level while the MACD indicator is in the oversold zone. This will limit the pair's downward potential and lead to an upward market reversal. Growth toward the opposite levels of 1.3704 and 1.3754 can be expected.

Sell Signal

Scenario No. 1: I plan to sell the pound today after an update (break) of the 1.3678 level (red line on the chart), which will lead to a rapid decline in the pair. The key target for sellers will be 1.3625, where I will exit short positions and immediately open long positions in the opposite direction (expecting a 20–25 point move in the opposite direction). Pressure on the pound will return today if U.S. data is strong.Important! Before selling, make sure the MACD indicator is below the zero line and just beginning to decline from it.

Scenario No. 2: I also plan to sell the pound today in case of two consecutive tests of the 1.3704 level while the MACD indicator is in the overbought zone. This will limit the pair's upward potential and lead to a downward market reversal. A decline toward the opposite levels of 1.3678 and 1.3625 can be expected.

What's on the Chart:

- Thin green line – entry price for buying the trading instrument;

- Thick green line – estimated level for placing Take Profit or manually locking in profits, as further growth above this level is unlikely;

- Thin red line – entry price for selling the trading instrument;

- Thick red line – estimated level for placing Take Profit or manually locking in profits, as further decline below this level is unlikely;

- MACD indicator – when entering the market, it is important to consider overbought and oversold zones.

Important

Beginner Forex traders should make market entry decisions very carefully. Before the release of major fundamental reports, it is best to stay out of the market to avoid sharp price fluctuations. If you decide to trade during news releases, always place stop-loss orders to minimize losses. Without stop-loss orders, you can quickly lose your entire deposit, especially if you do not use proper money management and trade large volumes.

Remember that successful trading requires a clear trading plan, like the one outlined above. Making spontaneous trading decisions based on the current market situation is inherently a losing strategy for an intraday trader.