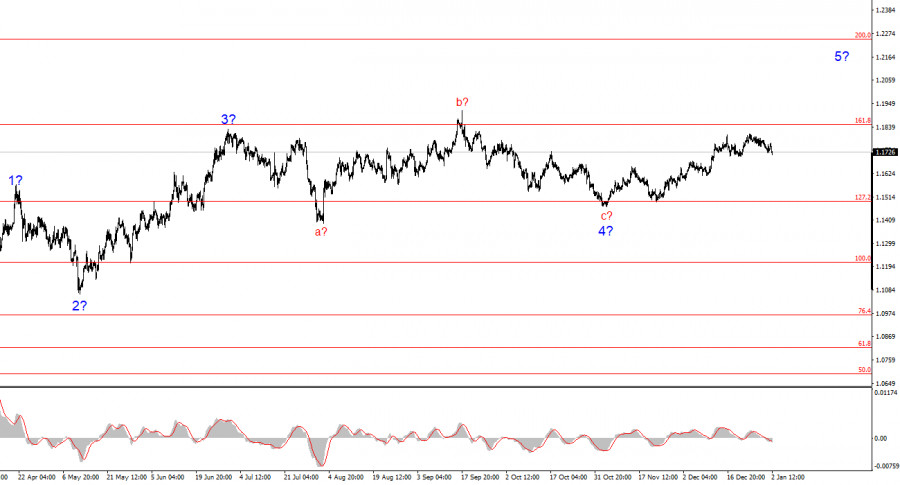

The wave pattern on the 4-hour chart for EUR/USD has been quite clear, albeit rather complex in recent months. There is no talk of canceling the upward trend segment that began in January of last year, but the wave structure starting from July 1, 2025 has taken on a complex and extended form. In my view, the instrument has completed the construction of corrective wave 4, which took on a very non-standard shape. Within this wave, we observed exclusively corrective structures, so there is no doubt about the corrective nature of this wave.

In my opinion, the construction of the upward trend segment has not been completed, and its targets extend as far as the 25th level. The series of waves a-b-c-d-e appears to be complete; therefore, over the coming weeks I expect the formation of a new upward wave sequence. We saw the presumed waves 1 and 2, and the pair is now in the process of forming wave 3 or c, which took on a five-wave structure and, therefore, has been completed. In the coming days, a decline in quotes can be expected, which is exactly what we are currently observing.

The EUR/USD pair declined by 10 basis points on Friday, although intraday movements were quite active. However, they were not active enough to conclude that the holidays were over. Most likely, the market will get back to business on Monday, when the first reports of the year begin to be released. For now, market participants can, with a clear conscience, continue to rest, finish their Olivier salad, and drink the remaining champagne. There is no news background, so I do not link the movements of the New Year week to any events — simply because there are none.

In my view, the pair is currently moving strictly according to waves, which is clearly visible even to beginner traders. Any trader knows that a classic impulsive (trend) structure consists of five waves, while a classic corrective structure consists of three waves. Within the local wave 3 or c, we observed five waves; therefore, a decline should be expected in any case. If the upward wave sequence that began on November 5 is not completed and takes on a five-wave form, then after the correction we will see a new rise in quotes. Personally, I support this scenario. However, there is another one.

The upward wave sequence may be limited to three waves, which would make it another corrective segment — and such segments have, by and large, been alternating for about six months. Of course, much will depend on the news background next week, as next week will be the first working week of 2026, so U.S. reports on unemployment, nonfarm payrolls, wages, and business activity will be released. These reports may trigger reactions from both buyers and sellers, since U.S. economic data still has a strong influence on FOMC monetary policy.

General conclusions

Based on the EUR/USD analysis conducted, I conclude that the pair continues to build an upward trend segment. Donald Trump's policies and the Federal Reserve's monetary policy remain significant factors weighing on the U.S. dollar in the long term. The targets of the current trend segment may extend as far as the 25th level. The current upward wave sequence may not be complete yet, but three waves have already been formed. If it continues to develop, growth should be expected with targets near 1.1825 and 1.1926, which correspond to the 200.0% and 261.8% Fibonacci levels. However, in the near term, a corrective wave or a set of corrective waves may be forming.

On a smaller scale, the entire upward trend segment is visible. The wave count is not the most standard, as corrective waves vary in size. For example, the larger wave 2 is smaller than the internal wave 2 within wave 3. However, this can also happen. Let me remind you that it is best to identify clear and understandable structures on charts, rather than necessarily trying to label every single wave. At the moment, the upward structure raises no doubts.

Core principles of my analysis:

- Wave structures should be simple and clear. Complex structures are difficult to trade and often signal changes.

- If there is no confidence in what is happening in the market, it is better not to enter it.

- There is no and can never be 100% certainty about the direction of price movement. Do not forget to use protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.